A PE investor must evaluate several factors in order to determine whether any given investment opportunity is a good one (and is appropriate for the PE firm). Research is needed in order to understand a company’s financials, market position, industry trends, and debt financing available. In the following pages, we’ll discuss how to assess an investment opportunity and conduct due diligence for all types of investments. While every company has its different nuances, this chapter will give you a general framework of how to analyze an investment opportunity and the various considerations involved.

Criteria for Good LBO Candidates

A good LBO candidate typically has the following characteristics:

- Strong market position and sustainable competitive advantages: This may seem obvious, but strong LBO candidates include companies that are market leaders with sustainable business models. This can be characterized by high barriers to entry, high switching costs, and strong customer relationships.

- Multiple avenues of growth: It is always helpful to have a balanced and diverse growth strategy, so that a company’s success is not completely reliant on one driver. This could include growth through the introduction of new products, increasing in the number of locations, new customers, increasing the penetration of current customers (upselling products), exploring adjacent industries, and expanding into new geographies, among other possibilities.

- Stable, recurring cash flows: Due to the reliance on high leverage, PE firms must find companies with stable and recurring cash flows in order to have sufficient cash flow to service all of its debt requirements. This requires to have relatively low exposure to seasonal fluctuations in cash flows, as well as low sensitivity to cyclical fluctuations (i.e., relatively immune to economic downturns and/or commodity prices).

- Low capital expenditure requirements: Companies with low maintenance capital expenditure requirements provide management more flexibility in terms of how it can allocate the company’s capital and run its operations: investing in growth capital expenditures, making bolt-on acquisitions, growth in its core operations, or give back capital to its shareholders in the form of a dividend. Capital-intensive businesses will typically generate lower valuations from private equity firms since there is less available capital (after interest expense), and there is increased financial risk in the deal.

- Favourable industry trends: Private equity firms are continually searching for companies that are well-positioned to benefit from attractive industry trends, since it results in above market growth and provides stronger equity return potential as well as stronger downside protection for the investment. Examples include increasing automation, changing customer habits, adoption of a disruptive technology, digitalization, changing demographics, increasing regulation, etc.

- Strong management team: A strong management team is crucial to success as private equity firms will provide strategic guidance but will almost exclusively rely on management to execute their operating strategy. If a company does not have a strong management team, the private equity firm must have a replacement ready before even seriously contemplating the investment.

- Multiple areas to create value: In addition to the characteristics above, a good LBO target candidate will also have multiple areas where the PE firm can create additional value. Examples include selling underperforming assets, increasing the efficiency of operations, pricing optimization, organizational structure, and diversifying the customer base.

Areas of Due Diligence

A crucial part of the investment process is the due diligence performed on the company. Think of it like an investigation process for a potential investment: PE firms will perform very detailed due diligence in order to ensure that they are making a sound investment. This process is crucial to the success of the investment, and the financial sponsor must look at all critical aspects of the target company: commercial, financial, and legal. The vast majority of the time is spent on commercial due diligence while the financial and legal areas are more confirmatory in nature. PE firms rely on consultants for their expertise and advice for portions of the due diligence process, but ultimately the investment decision is the firm’s responsibility. This section provides questions and topics that are often evaluated while looking at an investment opportunity.

Commercial due diligence includes understanding the company’s value proposition, market position, historical performance, and industry trends in order to assess the target’s ability to achieve its forecasted projections.

Sample due diligence questions include:

Competitive Landscape and Market Position: It is important to understand how sustainable the target’s business model is and where it is positioned relative to its competitors.

- What is your competitive advantage (e.g. product offering, technology, price, premium brand, distribution capabilities, geographic presence, fully-integrated solution, etc.)? Is this a disruptive business model (i.e., one that changes the landscape of how business is done in this space in some way)?

- What are the barriers to entry into the business? What are the costs of switching to a competitor’s product?

- Where does the company fit in the industry value chain? How has the industry changed over the last 5 years? How do you expect that to change over the next 5 years?

- Who are your main competitors? From whom have you been gaining/losing market share? What firm is the biggest threat to your company? What is the biggest share gain opportunity?

- What is the market landscape (e.g. oligopoly, fragmented market, first-mover, etc.)? How saturated is the market?

Industry Growth/Addressable Market: When evaluating the industry, it is crucial to understand the market environment and the external factors affecting the business.

- What is the historical growth of the market? What is the projected growth of the market over the next 5 years? How mature is the industry?

- What is the total addressable market? What segments of the industry are growing faster than others?

- Describe the key macroeconomic drivers of the business. What are the trends?

- Have there been any significant changes to the industry landscape (e.g. disruptive new entrants, consolidation, vertical/horizontal integration, demand/supply imbalance, etc.)?

- What are the regulatory concerns and how can it adversely affect the business?

Customer Base/Suppliers: This entails understanding the “stickiness” of customers and the company’s reliance on suppliers.

- How many customers do you have? What is the concentration of your top 50 customers?

- What is the typical contract length of a customer relationship? What is a typical renewal rate? What percentage of customers have multiple products?

- Who are the key decision makers for the customers? What are the buying dynamics? How long is the entire sales process?

- Please describe your most recent customer wins and losses. What were the main reasons?

- How many suppliers do you have? What is the concentration of your top suppliers? How large of a customer are you to them? What is the average length of the relationship? How often are your supply contracts renegotiated?

- If you receive price increases from your suppliers, are you able to pass it through to your customers?

Capital Requirements of the Business: A good understanding of the total capital needed to run the operations of a business is needed, especially during difficult times.

- How capital intensive is the business? What percentage of capital expenditures is growth capital vs. replacement/maintenance capital? How has that trended over the last 5 years? What kind of lead-time is needed (i.e. time from purchase order to delivery) when making a purchase order? How large of a deposit is customary for new purchases?

- How cyclical is the business? Are there any severe seasonal changes in demand? What are the factors? How much visibility do you have in expected sales?

- What percentage of the COGS cost structure is fixed vs. variable? What is the breakdown of operating expenses?

- What is the normal working level of cash to run the business for a year?

- At what manufacturing capacity is the company running right now? How quickly and to what extent can it be reduced if demand falls?

- What would be your biggest concern in a downside scenario?

Financial Performance (Historical & Projected): This analysis provides a deeper look into the company’s historical performance in order to understand how realistic the company’s forecasted projections are.

- Provide a comparison of the historical performance to the management budgets for the last 5 years. Describe the methodology behind the budget and the reasons for beating/missing the budget.

- What are the key performance indicators (KPIs) the management uses to monitor the business? Describe the trends in these indicators.

- Break out your organic growth over the last 5 years (not including the impact from acquisitions).

- Provide your 5-year financial model and describe the key drivers in your projections.

- Growth: Please describe key assumptions. How does it compare to expected market growth? Where will it come from (increase in price, increase in volume, increase in market share, new products, acquisitions, etc.)?

- Margins: Please describe key assumptions. Why (for example) do you expect margins to increase so significantly compared to historical performance? Where will it come from (operating leverage, cost efficiencies, higher margins on products, revenue/cost mix, etc.)?

- KPIs: Describe key assumptions. How do they compare to the industry average and/or your main competitors?

- What are the primary risks to this forecast (new product introduction, successful expansion into new geography, customer concentration, sufficient hiring of employees, R&D resources, etc.)?

Financial due diligence confirms that all the financial information provided is accurate and helps PE firms understand some of the unique dynamics of the company from a financial reporting perspective. The firms typically hire accountants and/or auditors to review the financials, operations, customers, markets, and tax issues in detail. This is usually referred to as “transaction advisory services.”

The main areas of financial due diligence include:

Quality of earnings: The PE firms need to confirm the historical earnings of the company excluding non-recurring costs/expenses, as this will affect the valuation of the company. Consequently, they hire accountants to ensure that the information the company provides is accurate. Accountants review the company’s historical performance to understand the target’s actual EBITDA, adjusted for non-recurring costs. Adjusted EBITDA is critical because that is what will drive the company’s valuation (Adjusted EBITDA × EBITDA multiple = Purchase Price). These adjustment types include management adjustments, business-related adjustments, and pro forma adjustments.

- Management adjustments are common when purchasing family-founded businesses where compensation is very flexible. Adjustments include one-time or excess owner/executive compensation, transaction costs, legal settlements, and personal expenses (like a private jet, accounting fees, etc.).

- Business-related adjustments include accounting-related issues, such as accounting true-ups for bonuses and reserves, inventory valuation, revenue recognition, accrual/reserve reversals, etc. These adjustments also include lost customers and unsustainable margins or cost cuts.

- Pro-forma adjustments occur when the company has made recent acquisitions or divestitures. They are attempting to answer the following question: given the current business structure, what would historical earnings have been, pro forma for the acquisitions/divestitures? This review includes synergies (eliminated positions & facilities, scaled pricing, major customers, audit/tax fees, open positions, known cost increases, etc.).

Debt and debt-like items: During the review, firms need to calculate the company’s total debt-like items outstanding, because it will impact the total amount given to the sellers (Total purchase price less debt = cash given to sellers). All liabilities will be categorized as either working capital or debt, not both. Sellers have an incentive to have lower debt & debt-like items, but buyers need to ensure that the amount of debt owed isn’t misrepresented. For example, capital expenditures may not be accurate because the company could have ordered a lot of equipment but have yet to pay for the purchase, which results in a payment post-acquisition, thus affecting the total cash available after the deal. In addition, debt-like items are often buried in accounts payable and accrued expenses. Other common debt-like items can be found in deferred compensation, termed accounts payable, shareholder payables, legal settlements, tax related liabilities, and liabilities associated with certain cash transactions.

Normal working level of capital: The PE firm assumes that the company needs a normal level of working capital to remain in business, and thus removes it from the purchase price. The accountant must identify adjustments to reported working capital (this involves determining and reporting on the Quality of Operating Working Capital), and assist with setting an operating working capital target. Beyond setting a working capital target for the purchase price, the accountant must perform due diligence to understand the other unique dynamics of the business model to optimize the operations during various economic cycles. This would require looking at the characteristics of the company’s cash flow, deferred revenue, orders, revenue recognition, and seasonality of the business.

Tax structure: This process entails looking at the tax structure of the company and providing a detailed analysis of the federal, state, local, and international tax situation (both historical and anticipated). Federal taxation occurs at the national level and includes a review of tax assets, structure the company, step-up calculations, compliance procedures, and identification of the potential tax liabilities. State and local taxation are based on the location of the company. This entails a review of the payroll, use tax, and sales compliance procedures as well as a high level assessment of potential tax liabilities. International taxation deals with the transfer pricing as the company conducts business globally. This also refers to the tax structure of the company after the acquisition. By looking closely at a company’s tax structure, the analysis can provide insight into the best methods and locations for tax compliance so that the company may maximize its net profit and minimize its tax liabilities.

Information technology: IT issues can cause a significant block in a smooth transition if the systems are not reviewed correctly and comprehensively. The smooth process of IT systems is crucial to conducting accurate reviews of tax liabilities and accounting as well as maintaining historical financial records.

Human resources: HR plays an important role in due diligence because it affects payroll and that in turn affects the taxes for which the company is responsible. State filing requirements and income regulations are based partly on the location of the payroll.

Legal due diligence is mainly confirmatory. It is focused on confirming that the target company is not subject to any future liabilities including regulatory issues, threatened or ongoing lawsuits, and unusual or onerous contract provisions.

Corporate filings: This component of the legal due diligence process is to confirm that all corporate filings have been filed correctly (corporate organization and documents) and to understand the legal organization of the company, such as whether there are any strange corporate structures.

Material contracts: Prior to acquiring a company, it is important to look at past and current material contracts. This includes the debt structure, acquisitions and other liabilities, and it may include key customer, partner or supplier agreements.

Property, plant and equipment: It is important to consider the company’s property, plant and equipment to study its assets and liabilities. One example of this is a detailed review of key operating or capital leases.

Human resources: HR due diligence is another important area in legal due diligence, and it refers to the target company’s management team and employees. Any HR risks need to be captured in the valuation model. The firm will look at employment terms/agreements, individual contracts, collectively bargained agreements, and retention/severance agreements. In conjunction, a review of the management and employees are necessary. The compensation structure is crucial to understanding the organizational and operational structure of the company. This includes compensation for executives, and the possible severance required if they are to be terminated during the deal. This also includes other salary and stock option plans to key employees.

Health and welfare plans: The target company will have various benefit plans set up, which must be evaluated as the acquisition is taking place. The firm reviews the health benefit plans, retiree health plans, and retirement plans to understand any regulations or legal issues surrounding the benefits.

Information technology: Reviewing the company’s IT structure during legal due diligence is very important. Assessing the company’s information technology and related agreements can provide further insight into the company’s weaknesses and strengths. The review includes looking at software or hardware agreements with external parties, contractually obligated product features or service level agreements, license agreements, and other technology agreements.

Lawsuits/litigation/patents: A look at the company’s lawsuits/litigation provides a summary of any pending litigation, history of past litigations, and what may arise in the company, such as environmental, employment, customer or worker compensation issues. Similarly, a careful review of the intellectual property (IP) will be useful because the company’s proprietary information can help raise its value. Valuable IP can include patents/trademarks, domain names, trade secrets, and design rights that are exclusive to the company and help drive its business. Regulatory issues can also come into play here. On example of this is the need to review the possibility of asbestos liability for certain companies in some industries.

Environmental: Another crucial aspect of operations is to understand any potential liabilities the business is exposed to in its environment while conducting the day-to-day processes, such as hazardous material or toxic waste. Each business has specific types of environmental issues, and they will vary based on the industry.

Capital Structure Considerations

Capital structure considerations are important for all private equity deals, but this is most relevant for LBOs, because they rely heavily on leverage to produce attractive returns to equity investors. Leverage creates investment risk, however, and choosing the optimal capital structure is therefore extremely important. The optimal capital structure will also heavily influence how the target company runs its operations. Firms need to weigh the pros and cons of the cost of the debt and the capital structure’s flexibility as well as how much debt is suitable for the company.

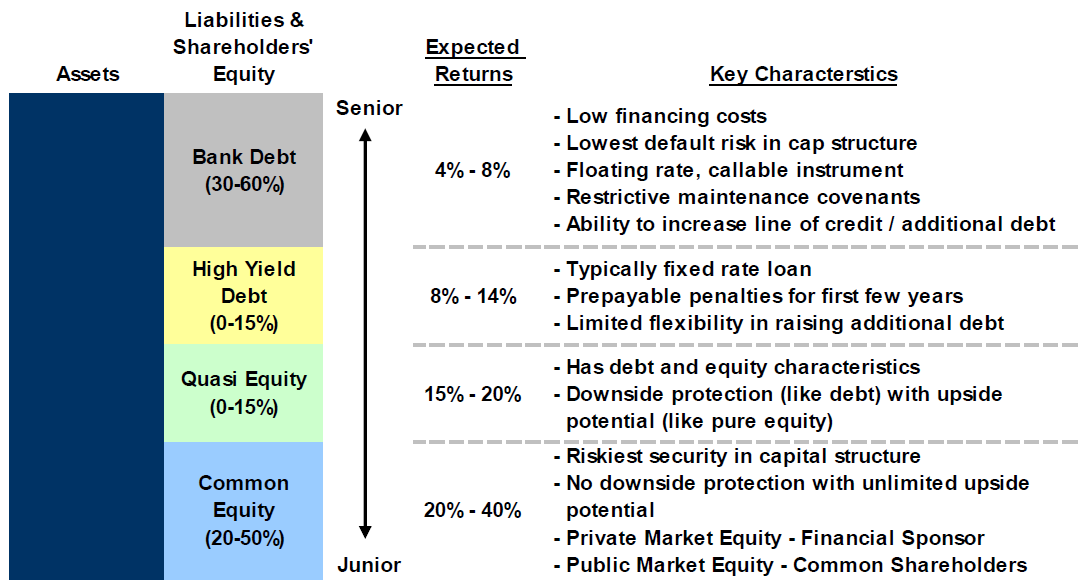

The figure below illustrates a typical capital structure for an LBO transaction, and some of the key characteristics and considerations for each tranche (slice) of the capital structure.

- Senior debt: The largest component of an LBO company’s capital structure typically is the senior debt or bank debt (otherwise referred to as “first lien” or “second lien”). Senior debt has the lowest financial cost and is the first in line in the capital structure to receive its money during the liquidation of the company. In addition, senior debt is sometimes secured by the company’s assets. However, the tradeoff is that the company is typically burdened with strict maintenance covenants to protect the senior/bank debt investors. Such covenants can include total leverage covenants and interest coverage covenants. Also, senior debt typically requires annual principal payments (referred to as amortization payments), which creates a burden on the company to generate sufficient cash flow from its operations. Senior debt typically matures after 5-7 years and has a floating coupon (i.e., the interest rate fluctuates based on an index such as LIBOR).

- High yield debt or subordinated debt: This kind of debt typically represents 20% to 30% of the LBO capital structure and has higher financial costs than senior debt. In contrast, high yield debt usually has less restrictive covenants or limitations, a longer time to maturity, and no required amortization payments. Subordinated debt typically matures after 6-8 years and has a fixed coupon or interest rate. One restrictive characteristic of high yield debt is that it is often not pre-payable by the company for a few years, so that high yield debt investors can lock-in their high interest rate for at least a couple years. If a private equity firm is looking to raise additional debt within the first few years of investment (e.g. for a bolt-on acquisition), it will typically avoid a high yield debt structure, because it would then likely incur high prepayment penalties. This portion of the capital structure can also include some combination of bridge financing, mezzanine financing, or “quasi equity”.

- Equity: This represents 20%-50% of the total capital of an LBO investment and is the most junior portion of the capital structure. In other words, common equity shareholders are paid last during a liquidation of a company. Equity holders require the highest rate of return on investment (approximately 20% to 40%) due to the high level of risk being taken by equity investors. For example, the equity holders often will receive no value if the company defaults on its debt payments (i.e., the entire equity investment will become worthless).