Private equity (PE) is an asset class for investing in public and non-public companies or physical assets, such as real estate. These investments typically result in either a majority or substantial minority ownership stake in a company. The investments can offer very strong return streams that are frequently much less correlated with indices than the returns available in classic public market investment opportunities.

However, the tradeoff is that these investments are much less liquid and require a longer investment period. Depending on the fund size and investment strategy, a private equity firm may seek to exit its investments in 3-5 years in order to generate a multiple on invested capital of 2.0-4.0x and an internal rate of return (IRR) of around 20-30%.

In order to amplify returns, private equity firms typically raise a significant amount of debt to purchase the assets they invest in, in order to minimize their initial equity requirement (i.e. they use leverage). This investment strategy has helped coin the term “Leveraged Buyout” (LBO). LBOs are the primary investment strategy type of most Private Equity firms.

History of Private Equity and Leveraged Buyouts

J.P. Morgan was considered to have made the first leveraged buyout in history with his purchase of Carnegie Steel Company in 1901 from Andrew Carnegie and Henry Phipps for $480 million. Morgan employed a substantial amount of debt to assist with this purchase. Later, in 1946, the first two ongoing private-equity firms were established: the American Research and Development Corporation, and J.H. Whitney & Company.

After laying fairly dormant on Wall Street for a while, private equity became explosively popular during the 1980s, with famous large buyouts being attributed to equally famous PE investors. Two examples are Jerome Kohlberg, Jr. and Henry Kravis, who formed Kohlberg Kravis Roberts (KKR), and famously purchased RJR Nabisco in a leveraged buyout by beating the CEO in a bidding war over the company. This transaction is immortalized in the book (and later made-for-TV movie), Barbarians at the Gate, which details the famous transaction. This transaction is but one of the many famous LBOs and hostile takeovers that were part of the merger and acquisition mania of the late 1970s and 1980s.

Between 1979 and 1989, it is estimated that more than 2,000 leveraged buyouts occurred, with a total transaction value of over $250 billion. As mentioned earlier, the most notorious of these deals was KKR’s $31.1 billion RJR Nabisco buyout. Although this was the largest leveraged buyout ever at the time, many people believed at the time that the RJR Nabisco deal represented the end of the private equity boom of the 1980s, because KKR’s investment, however famous, was ultimately a substantial failure for the KKR investors who bought the company. Other major firms created during this decade include Bain Capital, Hellman & Friedman, The Blackstone Group and The Carlyle Group.

More recently, the history of private equity is often regarded as having two eras: pre-2008 and post-2008. In the early 2000s and especially 2005-2007, private equity firms were able to complete blockbuster buyouts due to liberal US monetary policy and strong credit markets, which resulted in historically low interest rates, lax lending policies, and large amounts of debt financing available. Large-scale buyouts were becoming ever more prevalent, as seen by LBOs of Toys “R” Us ($7 billion), Hertz Corporation ($15 billion), Energy Future Holdings ($44 billion), Harrah’s Entertainment ($27 billion), and Hilton Hotels ($26 billion). These deals were among the largest ever in size, but similar to RJR Nabisco, they did not produce strong returns for their investors.

2008, however, marked an entirely new investing environment for PE firms due to the beginning of the credit crunch and global economic crisis. PE firms had difficulty finding attractive investments and an even harder time obtaining debt financing, as investors remained on the sidelines and investment banks (firms that typically underwrite debt financings) were struggling with their own balance sheet problems. This resulted in fewer buyouts and a return to the norm of smaller deals. To compare: the PE industry in the U.S. alone made 7,590 deals in the period 2005-2007, accounting for nearly $1.1 trillion in value, but during 2008-2010, there were 5,056 deals worth only $408 billion, showing a 62% drop in capital employed.

As the recession lifted, however, private equity buyouts gradually began to return, and in 2012, the deals were again in the billions (though still nowhere near the levels of the 2005-2007 boom years). Fundraising for PE investments in general has been much more difficult since 2008, because of both investors having less capital to invest in private equity, and private equity funds having difficulty generating consistent returns for its investors. In addition, a lot of the money that was raised in the boom years (2005-2007) still has yet to be used for buyouts. This overhang of committed capital prevents many investors from committing to invest in new PE funds. Overall, it is estimated that PE firms manage over $2 trillion in assets worldwide today, with close to $1 trillion in committed capital available to make new PE investments (this capital is sometimes called “dry powder” in the industry).

- PE firms are making a conscious effort to invest in more socially responsible companies.

- Many prominent PE deals in decades past, such as KKR’s acquisition of RJR Nabisco, are seen as displays of greed and exercises in hubris, while today, practically all PE deals are executed with the sole intention of creating economic value for shareholders and the economy at large.

- The general public has begun to see how buyouts can play a beneficial role in improving companies and sustaining economic growth. Instead of being seen as an industry that focuses on making operations leaner through layoffs and restructuring, PE firms are starting to be seen as being able to help sustain and build companies, as well as increase employment levels.

Types of Private Equity Investments

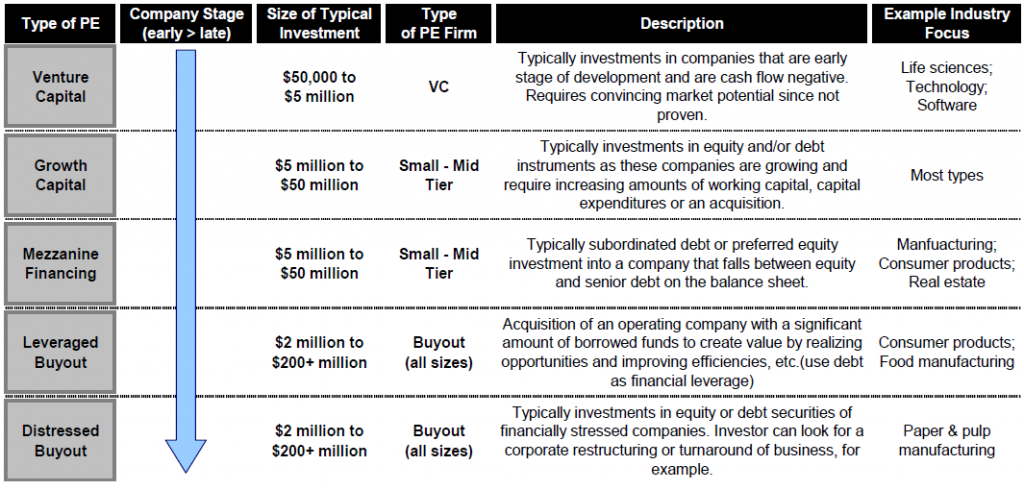

PE firms can invest in a wide mix of private investment strategies, with the mix varying greatly from firm to firm depending on the firm’s size, stated investment strategy, and industry and transaction expertise.

Venture Capital: A venture capital (VC) investment typically involves a minority investment in a high-growth company with minimal revenue. These investments are made at an early stage in the company’s life cycle. VC deals usually result in equity stakes in these startup businesses, and are usually characterized as high-risk/high-return (“boom or bust”) opportunities. This method of investing is popular among newer companies because they generally do not have access to debt markets to raise capital.

Typically, VC investments have the possibility of blockbuster returns for the investor. For instance, an initial investment could be seed funding for the company to start building its operations. Later on, if the company proves that it has a viable product, it can obtain Series A financing for further growth. A start-up company can complete several rounds of series financing prior to going public or being acquired by a financial sponsor or strategic buyer. It is not uncommon for VC deals to return 10x multiples of invested capital to investors (or potentially even more).

Growth Capital (also referred to as Growth Equity): Growth capital investments typically consist of a private equity firm making a majority or minority ownership stake in an early-stage company. These investment opportunities typically involve companies that are more developed than classic VC investment companies, making them less risky than VC investments, but with less upside potential.

Growth equity firms extensively research various industries and market trends in order to identify attractive investment opportunities. They are looking for companies where they can add significant value in order to help companies realize their market potential and become market leaders in their respective industries. This expertise can come in a variety of forms including strategic guidance, operational support, management expertise and efficient capital allocation. A successful growth equity investment will typically return at least a 3x multiple of invested capital to investors. A few notable growth equity firms include General Atlantic, Golden Gate Capital, TA Associates, and Warburg Pincus.

Mezzanine Financing: A private equity firm may offer mezzanine financing in the form of subordinated debt (junior to senior debt) or preferred equity, where return expectations are typically around 15%-20% per year. Mezzanine financing, in general, usually involves investor compensation in the form of interest combined with upside participation (i.e., equity or options/warrants on equity). Companies will often search for other sources of capital before turning to mezzanine capital, because it is expensive. However, this type of capital can help fill the gap between senior debt and equity when a private equity firm considers a leveraged buyout—mezzanine financing effectively lowers the required amount of equity capital invested in a leveraged buyout, and the equity capital has a higher required rate of return. Therefore, mezzanine financing, while expensive, can help reduce the overall required rate of return on the capital used to execute the LBO, by lowering the required equity investment, and thereby make some LBO deals feasible that otherwise were not.

Leveraged Buyout (“LBO”): A leveraged buyout is the acquisition of a publicly or privately-held company, typically characterized by the significant amount of debt financing used for the acquisition relative to the equity financing used. LBOs are the bread-and-butter investment strategy for most Private Equity firms. In an LBO transaction, a PE firm (also called a financial sponsor) or a group of firms (called a consortium or investor group) acquire the target company using debt instruments for the majority of the purchase price (debt typically represents about 60-75% of the total price). The leveraged buyout relies heavily on the future cash flows of the acquired business to service the interest expense on the debt and, additionally, pay down the outstanding debt as quickly as possible. (This pay-down is usually small at first, because the initial interest expense burden is substantial, but typically the pay-down amount grows each year as the company’s cash flow grows and as the outstanding debt balance decreases from previous pay-downs.) As the debt balance is lowered and the company’s value increases, the equity very quickly grows as a proportion of the company’s capital structure. It is this deleveraging process that can help lead to substantial gains for the equity holders in a successful LBO investment.

Top LBO PE firms are characterized by their large fund size; they are able to make the largest buyouts and take on the most debt. However, LBO transactions come in all shapes and sizes. Total transaction sizes can range from tens of millions to tens of billions of dollars, and can occur on target companies in a wide variety of industries and sectors.

Due to their reliance on high leverage, LBO firms must be adept at creating optimal capital structures for their target companies (a process sometimes referred to as “financial engineering”). LBO firms rely on financial engineering as a skill that is core to their investment strategy—much more so than growth equity firms, who focus almost exclusively on company value creation. Well-known LBO firms include KKR, Blackstone, The Carlyle Group, TPG Capital, Goldman Sachs Private Equity, and Bain Capital.

Distressed Buyout: In a typical distressed buyout, a private equity firm purchases a financially distressed company below market value with the intention of divesting the company in the future for a higher value. The two main causes of distress for a company include excessive financial leverage and operational volatility, such as a cyclical business. Prior to executing a distressed buyout opportunity, a distressed buyout firm has to make judgments about the target company’s value, the survivability, the legal and restructuring issues that may arise (should the company’s distressed assets need to be restructured), and whether or not the creditors of the target company will become equity holders. If the creditors are likely to become equity holders, they will acquire many rights as full or partial owners of the business, and this can lead to very important issues regarding control of the business.

Private Equity Fund Structure

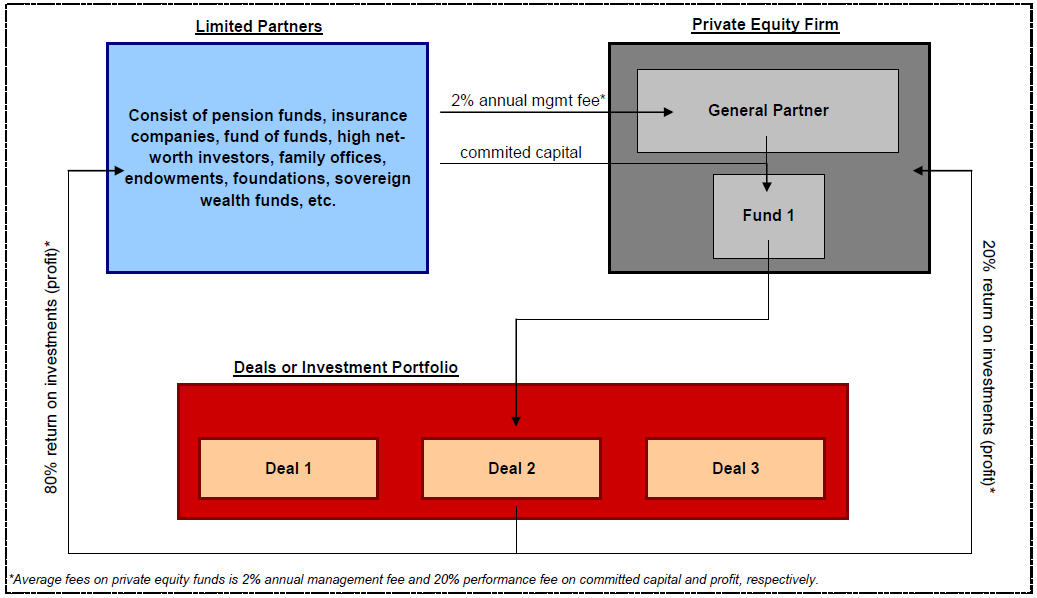

A private equity fund, also known as a general partner, consists of an investment team that raises committed capital from outside passive investors known as limited partners. Limited partners typically are made up of endowments, pensions, high net worth individuals, and institutional capital. The general partner invests the capital in public and private companies, manages the portfolio of investments, and seeks to exit the investments in the future for sizeable returns. A typical fund for a private equity firm has a total lifespan of approximately 10 years. The PE firm is required to invest each respective fund’s capital within a period of about 5-7 years and then usually has another 5-7 years to sell (exit) the investments. PE firms typically use about 90% of the balance of their funds for new investments, and reserve about 10% for capital to be used by their portfolio companies (bolt-on acquisitions, additional available capital, etc.). Funds can span different sectors, risk appetites, investment horizons, or any other investment style, but firms often specialize in one area (or a couple of related areas) and focus on growing their expertise and returns there.

A PE firm sustains itself through a continuous cycle of raising capital. As PE firms grow their capital base from funds, they are able to grow the firms, as a result of the increased fees received for managing the investments in the various funds they are managing. Conversely, if a PE firm does not have a strong investment track record, it may be forced to unwind its operations if it is unable to raise additional capital by raising new investment funds.

Here’s an example: a private equity firm may raise its first fund, which it could call Fund 1. Fund 1’s committed capital is being invested over time, and being returned to the limited partners as the portfolio companies in that fund are being exited/sold. Therefore, as a PE firm nears the end of Fund 1, it will need to raise a new fund from new and existing limited partners to sustain its operations.

Once 50% of Fund 1 has been invested to acquire companies, the PE firm will most likely need to make preparations to start fundraising for Fund 2. If the PE firm is able to show an impressive track record of returns from Fund 1, it should be able to raise larger sequential funds (starting with Fund 2). But if Fund 1 is not doing very well, it may struggle to raise capital for Fund 2, which will possibly jeopardize the firm’s ability to continue operations.

Typical Fees

Due to the specialized expertise of private equity firms, they are able to charge fees to their limited partners when managing their investments. They do so through two primary sets of fees: annual management fees across total assets under management (AUM), and a performance incentive fee based on a hurdle rate. While this varies by firm and possibly by fund, typical management fees consist of 2% of the total assets under management annually, and performance fees of 20%, which are taken from exited (“realized”) investments.

A PE firm’s performance fees are also called incentive fees, carried interest or carry. There is typically a hurdle rate (an annual required return of 7-10%) that general partners must achieve before performance fees are allowed to be taken. The structure of these performance fees motivates the partners of private equity firms to generate large returns; they are intended to align the interests of the general partner with the limited partners. Hurdle rates force PE firms to strive for generating above-market returns, since they stand to earn a large amount of money from the share of profits made on successful investments beyond the hurdle rate of return.

PE Firm Focus

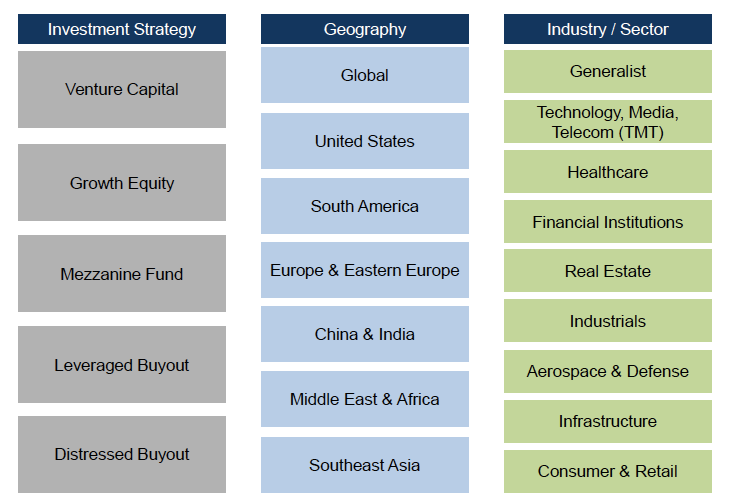

There are many different types and sizes of private equity firms and funds. A private equity firm could have multiple funds that can specialize in either a specific industry or a specific geography. Private equity firms create funds to focus on areas where they think that can create value for companies. The figure below illustrates the types of investment strategy, geography and industry focuses a PE fund can specialize in.